UAE, China to enhance economic ties

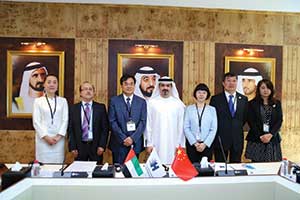

The Gulf Today | August 22, 2017- The Hamdan Bin Mohammed Smart University (HBMSU) has hosted a roundtable on the ‘Belt & Road Initiative’ and Islamic Finance Executive Strategy to promote economic cooperation between China and the UAE on Monday.

The forum was on the non-oil commercial and production sectors.

The event was held with the support of the Dubai Islamic Economy Development Centre and provided an opportunity to capitalise on the leading experiences of the UAE in Islamic finance to support China’s ambitious initiative of connecting the economies and trade activities of more than 60 countries. The meeting was jointly organised by HBMSU’s Dubai Center for Islamic Banking and Finance, the National Development and Reform Commission of the People’s Republic of China (NDRC), the China Islamic Finance Club, and ZhiShang Inter-Culture Communication.

Held under the theme ‘Sukuk and Economic Development: Opportunities and Challenges,’ the roundtable provided an international platform for exploring bilateral cooperation in the fields of trade, education, scientific research, and knowledge exchange under the Belt and Road Initiative. Discussions also centered on the challenges and opportunities in promoting Islamic financial instruments in China with a focus on Islamic sukuk. The impact of Dubai’s emergence as the largest Islamic sukuk hub in the world on Chinese companies was tackled as well.

Participants discussed the pivotal role of Dubai as a global capital for the Islamic economy to the success of the Belt and Road Initiative. They emphasized the need for more international investments in Islamic finance, which they agreed is a key pillar for the success of China’s efforts to consolidate the historic economic ties between European and Asian markets.

Dr. Mansoor Al Awar, Chancellor of HBMSU, highlighted the importance of maximizing the transfer of knowledge and expertise between intellectual and research institutions involved in Islamic finance in the UAE and China. He explained that this would help identify and propose strategic priorities for driving economic growth and comprehensive and sustainable development through Islamic finance, in line with the objectives of the ‘One Belt, One Road’ strategy.

The Chancellor pointed out that today’s gathering provided a high-level platform for exploring the opportunities offered to China by Dubai which acts as a gateway to lucrative markets in the Mena region and Sub-Saharan Africa. He noted that Dubai is backed by an advanced Islamic finance infrastructure supported by Nasdaq Dubai, mentioning that Islamic financial instruments open new prospects for reinforcing economic ties between China and countries along the economic belt of the Silk Road which engaged in trade worth $900 billion in 2016.

During the gathering, Abdullah Mohammed Al Awar, CEO of the Dubai Islamic Economy Development Centre, delivered a speech titled ‘China-UAE Relationship: The Road Ahead.’

He also referred to the importance of creating a legal and legislative environment for driving the growth of Islamic financial institutions and their offerings under the Silk Road Initiative; supporting and developing laws for the issuance of Islamic sukuk; and enhancing coordination between Chinese banks and Islamic finance institutions in the Arab World and the international Muslim community.